Quant Research in Service of Financial Resilience

QuantByte is a public-facing service built to help individuals understand markets, financial nuance, and the tradeoffs that shape long-term outcomes. We translate academic research into clear, actionable learning paths and practical tools so everyday investors can grow with confidence through any market cycle.

Our Service Promise

QuantByte exists to make market literacy more accessible by combining research, education, and interactive learning tools.

Research With a Human Outcome

We turn market research into plain-language guidance so people can make calm, informed decisions.

Risk Awareness for Real Life

Many frameworks highlights risk, so learning turns into sustainable habits rather than one-off trades.

Systems Over Guesswork

Our tools combine analytics and education so you understand the why behind every decision, as well as the outcome.

Learning Tools

Interactive apps that help you explore risk, return, and portfolio behavior with clarity.

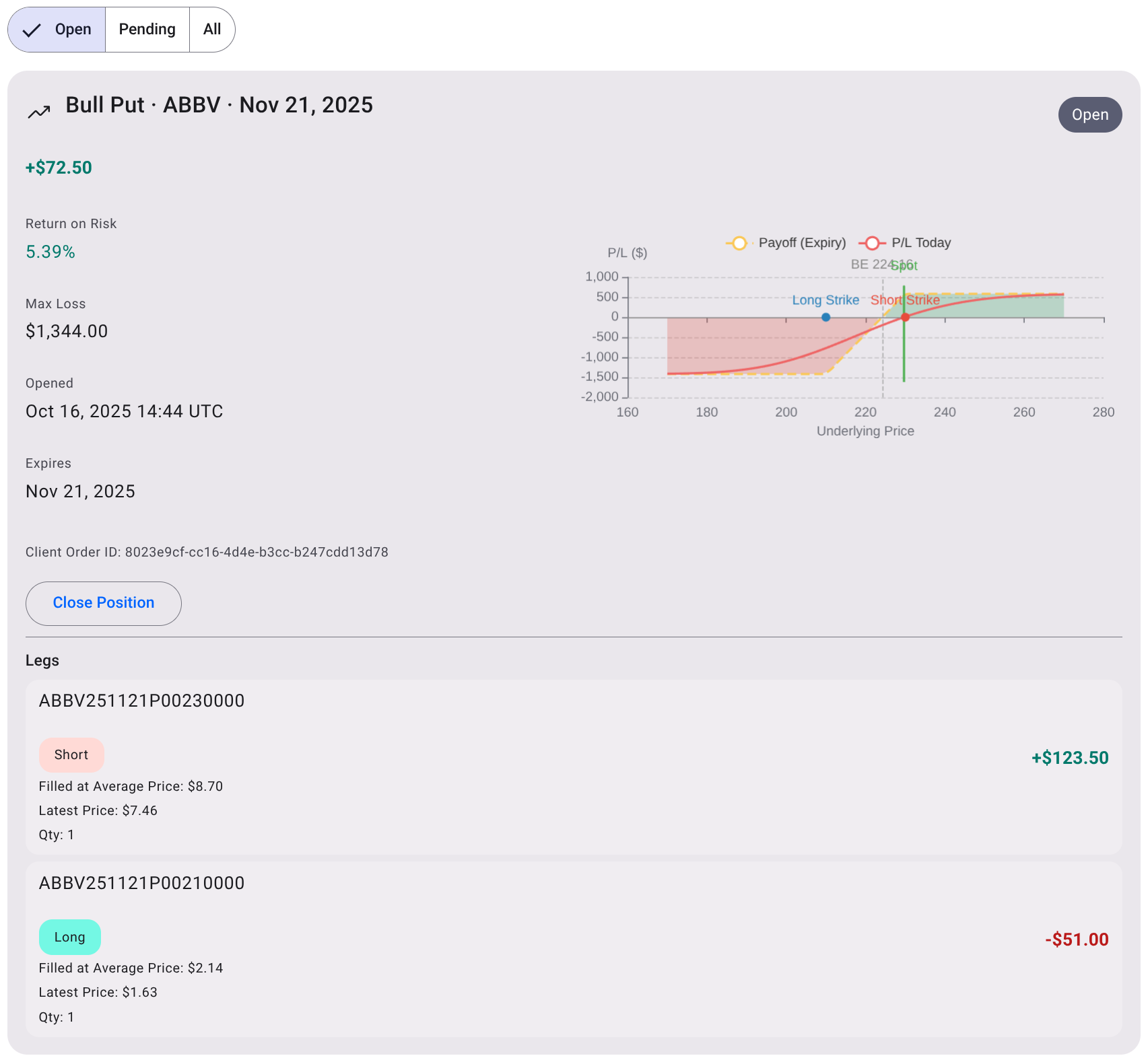

QuantByte Options

Structured options strategies with payoff visuals and risk-defined templates.

Designed for education and repetition, this app helps you understand volatility, payoff profiles, and disciplined entry logic.

Beta

Beta QuantByte Portfolio

Allocation benefits, portfolio construction, and the mechanics of long-term compounding.

A guided workspace for building diversified portfolios and understanding how risk and return interact over time.

QuantByte blog

Insights on financial independence, building resilient side income, quantitative strategies, and disciplined routines.

We publish research-backed explainers and frameworks so people can navigate markets with clarity, not hype.

"Markets reward disciplined learning long before they reward bold predictions."

Our mission is to turn complex financial systems into understandable pathways so more people can build durable wealth.